Tax Day Actions Include Protests and Refusal to Pay

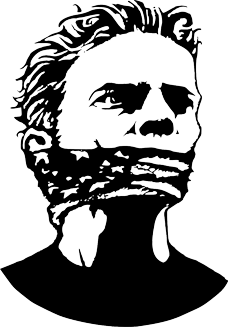

Individuals Divest From the Pentagon and Invest in People

From traditional Tax Day, April 15, 2016, through the final day to file in Maine and Massachusetts on April 19, hundreds of people in communities across the United States will take public action to call for a change federal budget priorities away from military spending and to human and environmental needs. Individually and in groups, many of these concerned activists will divest from the Pentagon by refusing to pay some or all of their federal income taxes, which help to pay for war.

Anne Barron, an urban farmer in San Diego, California, says, “San Diego is a very militarized city, with a number of large war contractors and military bases, but I have found people here are very responsive to the idea of peacemaking instead of bombs.” At a press conference in San Diego on Friday, April 15, Ms. Barron will announce her redirection of taxes to human rights groups in conjunction with an announcement of grants from a group of individuals who pool their resisted federal tax dollars into the Southern California War Tax Alternative Fund.

Similar

announcements of tax redirection take place in Eugene, Oregon, New York

City, and Asheville, North Carolina. Other groups and individuals will

hold public rallies, vigils, and leafleting at post

offices, IRS offices, federal buildings, and town squares to bring

attention to the harmful effects of military spending. A list of Tax Day

events in the U.S., with links to similar actions around the world, can

be found at http://nwtrcc.org/programs-

Refusing to pay taxes for war is an act of civil disobedience with a long tradition in the U.S. The most famous instance was Henry David Thoreau’s refusal to pay the $1.50 poll tax levied to help fund the Mexican War, which earned him an equally famous night in jail. Some people resist by living below a taxable income or by no paying a small part of the income taxes they owe. Others refuse to any of their income taxes to the federal government despite the risk of IRS sanctions. “I am psychologically unable to write a check to maim and kill,” says Kathy Labriola, a counselor and nurse who lives in the Bay Area of California.

Public

protests will take place at the Raytheon Missile Systems plant near

Tucson, Arizona; at the post office in downtown Colorado Springs; at

Federal Plaza in Chicago; at post offices across Maine; at the Army

Reserve base in Milwaukee; and at the headquarters of the IRS in

Washington, DC, among other locations. The full list with dates and

times is at http://nwtrcc.org/programs-

The National War Tax Resistance Coordinating Committee (NWTRCC) is a coalition of local, regional and national groups providing information and support to people who are conscientious objectors to paying taxes for war. In 2016 actions are promoted under the slogan “divest from the Pentagon, invest in people.” NWTRCC has coordinated tax day actions since 1982 and has partnered with the Global Days of Action on Military Spending since 2011.

War tax resisters are available for interviews. Please contact NWTRCC, 1-800-269-7464, nwtrcc@nwtrcc.org, for contacts in your area.

Additional resources:

Where Your Income Tax Money Really Goes, War Resisters League pie chart, https://www.warresisters.org/

Stockholm International Peace Research Institute (SIPRI), http://www.sipri.org/research/

Global Day of Action on Military Spending, http://demilitarize.org/

Copyright mediaforfreedom.com